Southeast Asia is launching a regional trading system

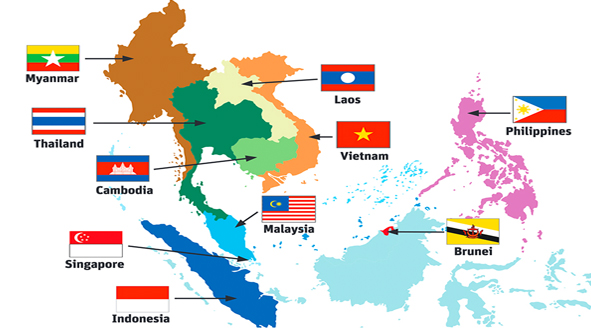

Establishing the ASEAN (Association of Southeast Asian Nations) countries for commercial cooperation and implementing the regional transaction system has been launched. Through the scheme, citizens will be able to pay for goods and services using QR codes in local currency. Currently, the transaction system has been launched in Indonesia, Malaysia, Thailand and Singapore. Launching soon in the Philippines. News agency CNBC reported.

Earlier, five Southeast Asian countries signed formal agreements. The ASEAN Summit was held in last May. There was a discussion about making plans for the country’s leaders to work together. There has been talk of implementing a regional currency, especially for the countries of the ASEAN region. Along with regional transactions, investments, trade, remittances and other economic activities will become easier. Economic and trade friendly environment will be created in Southeast Asia.

According to the analytical report, the retail industry in Southeast Asia will grow in the coming days. Consumer spending will increase along with the expansion of the tourism sector. As a result, regional connectivity is considered important. Leaders feel the need to reduce dependence on the dollar in business. However, the pace is slow as most countries in the region are dependent on imports for the energy sector.

A regional digital exchange system will develop a centralized economic system among ASEAN countries. As a result, the deadlock created by the tension between the global superpowers will be easier to overcome. Transactions and money transfer from one wallet to another wallet can be done through QR code. A digital wallet will play the role of a bank account. However, they will also be formally associated with economic institutions.

Malaysian tourists will be able to transact in Malaysian ringgit after visiting Singapore. On the other hand, Singaporeans working in Malaysia will be able to transact in Singapore dollars. In this case, the fee and exchange rate will be determined through mutual agreement and negotiation. The central banks of the two countries will participate in the discussion.

Switzerland is working to integrate global trade through QR codes in the retail services sector. Asian Development Bank researcher Satru Imadera called this effort of the central banks of the ASEAN region as creative and noble. In other parts of the world like Europe, he said, credit and debit cards have established uniformity in retail services. Through this the low income people will benefit the most.

They can manage transactions through digital accounts without the need for traditional bank accounts. The new system will also create new opportunities for traders and consumers. As a result, the adoption of policies will benefit the future economy. However, there may be pressure on some currencies such as the Singapore dollar in terms of transactions. For some currencies exchange rates with foreign currencies may depreciate. Central bank intervention may become necessary. In this situation the central bank can adopt appropriate policies.

As we can see the benefits that the citizen of the countries of ASEAN will have through these act, in SAARC, we can implement the same structure which will surly benefits billions of people of those seven SAARC countries which includes the members like India, Bangladesh, Pakistan, Nepal, Bhutan, Sri Lanka and Maldives which has inhabitants of about more than 2 billion people.

Comment here