Bankrupt Sri Lanka’s inflation rate is now lower than Bangladesh!

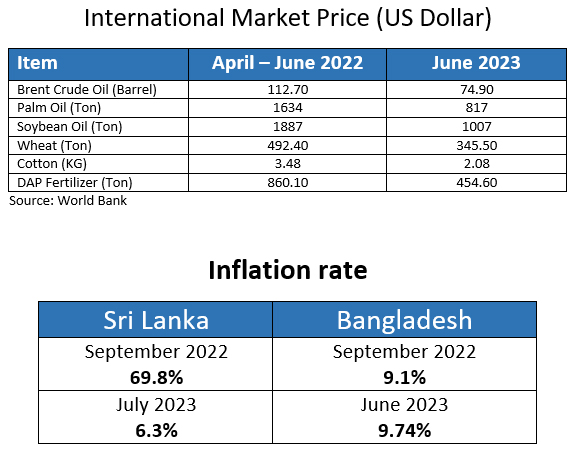

Long lines at food and fuel stores while food and fuel were not even available to get with double or triple in price. Inflation became a bigger problem last year for Sri Lanka, which finally declared as bankrupt for reserve crisis. The country’s inflation rate rose to a record high of 69.8% in September, 2022. All sectors and sub-sectors of the economy from household to industrial production were in trouble. At the end of the year, the rate of contraction in the economy stood at 7.8%.

Over the years, the situation is just the opposite in the country. The supply of food and fuel in the shops is sufficient. Apart from the government, some foreign companies have also been approved to sell fuel there at cheaper prices. The Central Bank of Sri Lanka (CBSL) led by Governor Nandalal Weerasinghe managed to reduce the inflation rate to 6.3% in July, 2023, according to the statistics department of the country. According to local media reports including ‘Economy Next’, the country’s central bank is targeting inflation as it gets under control.

At a time CBSL was increasing liquidity in the market by continuously printing Rupees. This was also seen as one of the major reasons behind the deteriorating inflation situation in the country. Currently, one of the biggest achievements behind the change in the country’s situation is being given to CBSL Governor Nandalal Weerasingh. He has now completely stopped printing currency in the central bank. He controlled the flow of credit by increasing the interest rate. Again, the market-based method has been followed in determining the increased interest rate. By controlling the central bank’s buying and selling of foreign currencies (especially the dollar), the rupees has been prevented from depreciating. Currently, the exchange rate of the Lankan rupee is increasing against other currencies including the US dollar. Various measures have been taken to control the flow of cash in banks. Instead of extending loans, scheduled banks are now required to deposit fixed rate liquidity deposits with the central bank. As the government borrows from the central bank but discounts it, other exchangeable assets are used instead of cash.

Dr. Debapriya Bhattacharya, Honorary Fellow of the Center for Policy Dialogue (CPD), said, “Bangladesh has not yet been able to take the opportunity to lower international market prices due to the internal policies of the government. It doesn’t even seem that the Inflation will be reduced by future measures either. The government has not fully implemented the policy yet. The biggest problem in this case is that the monetary policy and fiscal policy remain still in conflict. Interest did not rise that way. The exchange rate of the rupee is also not integrated. If these are combined, it is still difficult to say how the situation of inflation will stand. But it is less likely to decrease in near future.

In September last year, inflation in the island nation hovered around 70%, while inflation in Bangladesh was 9.1% and after 10 months it is still at 9%. According to the latest data released by the Bangladesh Bureau of Statistics (BBS), the country’s point-to-point inflation rate was 9.74% in June. Earlier in May, the inflation rate in the country stood at 9.94%, the highest in an era. Although the data for July has not yet been published, according to the information obtained from various related sources, the inflation rate in Bangladesh is less likely to fall below 9% at this time.

Economists and experts were skeptical about turning around of bankrupt Sri Lanka. The International Monetary Fund (IMF) also did not release a bailout package for Sri Lanka before March this year due to this uncertainty. Although since that time, the country has been able to improve the economic situation. According to NASDAQ data, the exchange rate of the country’s currency, the Sri Lankan rupee, has increased by about 10% since the beginning of this year.

Sri Lanka’s foreign exchange reserves are also on the upswing. At the end of last year, the total foreign exchange reserves of the country were 1.9 billion dollars. From there, it almost doubled to 3.7 billion dollars at the end of last June, according to CBSL statistics. The IMF loan and the subsequent development of the situation, the country is now getting new loans from various countries and international organizations.

Comment here